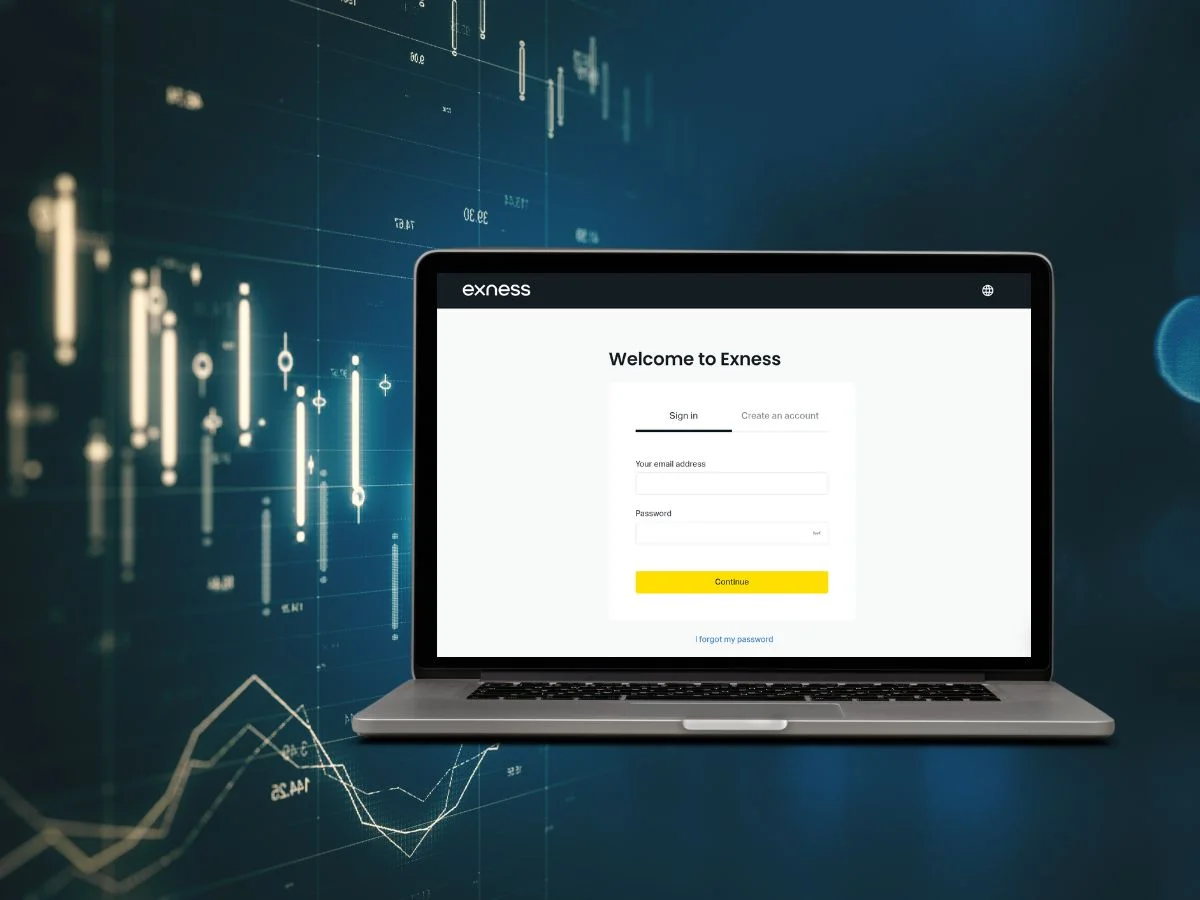

Introduction to Exness

Founded in 2008, Exness has rapidly grown to become a prominent name in the forex and CFD trading industry. Offering a variety of trading services, Exness is renowned for its user-friendly platforms, competitive spreads, and a wide selection of trading instruments. Over the years, the firm has built a solid reputation as a reliable broker for both beginner and professional traders.

Brief History and Development

Exness was established with the primary goal of providing transparent and effective trading solutions to traders worldwide. Through continuous innovation, it has expanded its reach globally, integrating advanced technologies into its platforms. Its growth is attributed to robust customer service, stringent regulatory adherence, and constant enhancements in trading tools and features. The company’s transparency and commitment to compliance have made it a significant player in the financial markets.

Is Exness a Legitimate Broker?

Regulatory Compliance

Exness operates under the oversight of several reputable financial authorities, such as the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). Additionally, it is regulated by the Financial Services Commission (FSC) in the British Virgin Islands, ensuring a secure trading environment for its clients. These regulatory bodies impose strict rules and standards, guaranteeing that Exness meets the highest industry practices in safeguarding client interests.

Awards and Recognition

Exness has garnered several awards over the years, highlighting its excellence in various aspects of trading. It has been recognized for its customer service, trading technology, and market execution, showcasing its dedication to providing a top-tier trading experience.

User Feedback and Trust

Exness enjoys mostly positive reviews from its user base, with traders praising the platform’s reliability, competitive spreads, and responsive customer support. Although individual experiences may vary, the general sentiment among users solidifies Exness as a trustworthy and dependable broker in the market.

Safety Measures at Exness

Protection of Client Funds

One of Exness’ core principles is the segregation of client funds. By keeping client money separate from the broker’s operational funds, Exness ensures that your capital is protected from being used for business expenses. Furthermore, the broker offers negative balance protection, meaning you won’t lose more than your initial deposit, a critical feature in volatile markets.

Data Security

Exness prioritizes the protection of client data by implementing SSL encryption, which secures all communication between the trading platform and the user. This encryption prevents unauthorized access and protects personal and financial information, ensuring confidentiality.

Client Account Segregation

In addition to secure transactions, Exness implements client account segregation. This means client deposits are held separately from the broker’s operational funds, minimizing the risk of misuse or misallocation. This adds a crucial layer of security for traders.

Trading Instruments on Exness

Forex Trading

Exness offers an extensive range of forex pairs, including major, minor, and exotic pairs, allowing traders to access diverse markets. The broker is highly competitive in terms of spreads, making it an attractive choice for forex traders who seek cost-efficient trading conditions.

Cryptocurrency Trading

Traders interested in the burgeoning cryptocurrency market can trade top digital assets like Bitcoin, Ethereum, and Litecoin. These cryptocurrencies are available alongside forex, allowing for portfolio diversification.

Commodities and Indices

Exness also provides access to commodity and index trading. Popular commodities such as gold and oil are available, alongside global stock indices, giving traders further diversification opportunities in both long and short trades.

Account Types at Exness

Standard and Pro Accounts

Exness offers both Standard and Pro accounts to cater to a broad range of traders. The Standard account is perfect for beginners with a low entry barrier, while the Pro account is designed for seasoned traders, offering tighter spreads and additional tools.

ECN Accounts

The ECN (Electronic Communication Network) accounts are ideal for high-frequency and professional traders. These accounts provide direct market access, with lower spreads and higher transparency, perfect for traders looking for quick execution.

Demo Accounts

Exness offers demo accounts to help new traders practice in a risk-free environment. It’s an excellent way to familiarize yourself with the platform and test out strategies without risking real capital.

Trading Platforms at Exness

MetaTrader 4 (MT4) vs. MetaTrader 5 (MT5)

Exness supports both MT4 and MT5, the two most widely used trading platforms globally. MT4 is user-friendly, with a simple interface perfect for beginners. In contrast, MT5 offers more advanced features, including additional timeframes, extended charting capabilities, and more sophisticated order types, catering to the needs of professional traders.

Web-Based Platform

For traders seeking flexibility, Exness provides a web-based trading platform that doesn’t require downloading software. This browser-based solution is ideal for traders who prefer convenience and quick access from any device.

Mobile Trading

Exness has developed mobile trading apps for both iOS and Android, enabling traders to manage their trades on the go. The apps offer full functionality, including real-time market access, account management, and order execution.

Spreads and Commissions at Exness

Fixed vs. Floating Spreads

Exness offers both fixed and floating spreads, giving traders the flexibility to choose based on their preferences. Fixed spreads provide stability, while floating spreads can offer lower costs during periods of low market volatility.

Competitive Pricing

Exness is known for its competitive spreads and low commissions, particularly for ECN accounts. This makes the broker an attractive option for traders looking to minimize trading costs.

Payment and Withdrawal Processes

Deposit Methods

Exness offers a variety of deposit methods, including bank transfers, credit cards, and popular e-wallets like Neteller and Skrill. The broker ensures fast and reliable processing of funds.

Withdrawal Timeframes

Withdrawals at Exness are typically processed within 24 hours for e-wallets, although bank transfers may take a few business days. The broker ensures transparent and timely processing to ensure traders can access their funds without delay.

Customer Support at Exness

24/5 Customer Support

Exness provides customer support via live chat, email, and phone, ensuring that traders can receive assistance quickly. Their customer service is available 24/5, covering major trading hours to resolve any issues in a timely manner.

Multilingual Support

With support available in multiple languages, Exness caters to traders worldwide, breaking down language barriers and ensuring smooth communication.

Learning Resources at Exness

Educational Materials

Exness offers extensive educational resources, including tutorials, articles, and videos aimed at helping traders of all levels improve their trading skills.

Webinars and Trading Signals

The broker regularly hosts webinars and provides trading signals to give traders up-to-date insights into market trends, helping them make informed decisions.

Conclusion

Exness stands out as a highly reliable and versatile broker, with a strong regulatory framework, competitive trading conditions, and excellent customer support. Whether you’re a beginner or an experienced trader, Exness offers a range of tools, platforms, and educational resources to suit your trading needs. Its commitment to transparency, client fund protection, and continuous improvement ensures that traders can rely on Exness for a safe and efficient trading experience.